US Dollar: The Calm Before The Storm

- Callum Thomas

- Jul 24, 2019

- 2 min read

Sorry about the blatant outright cliché in the title, but honestly, I just can't think of a better way to describe the recent moves in US dollar implied volatility...

The chart below shows our index for US dollar implied volatility, and the bottom line is that it has crunched down towards record lows in recent weeks. This is quite rare, and something that has on a few occasions been a harbinger of a large move/turning point.

Specifically, the indicator takes an average of 1-month option implied volatility across 11 different developed market USD-XXX pairs. In other words, it gives an indication of the general level of implied volatility for the US dollar.

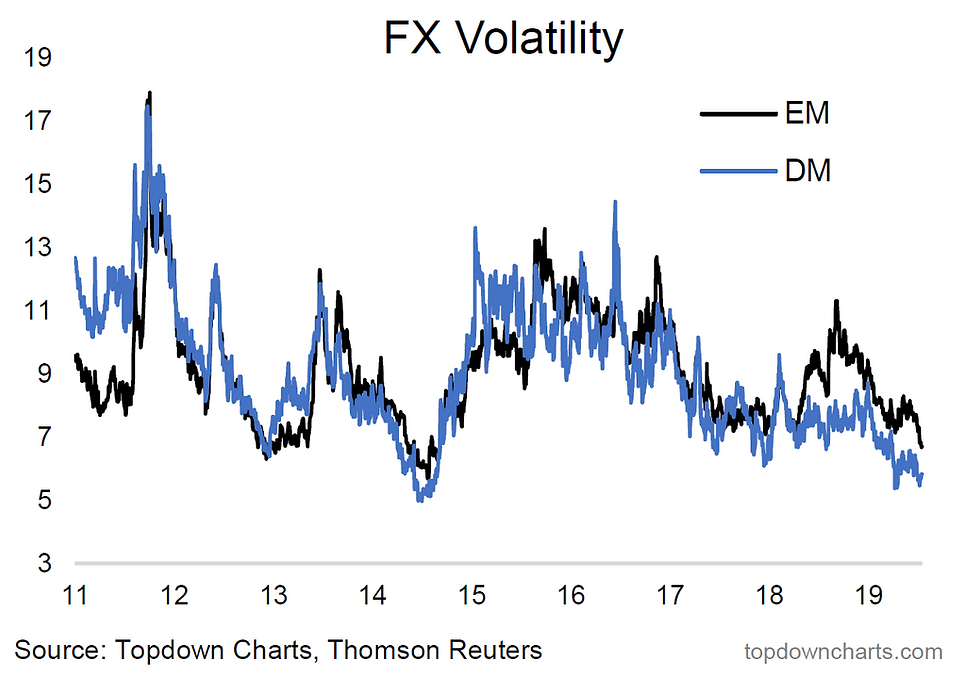

Just quickly, for those who might be interested, here's the same kind of indicator, but for emerging markets (from the Global Cross Asset Market Monitor). It's pretty much the same story for emerging markets: i.e. EMFX vs USD implied volatility has been crunching in too.

So what's behind all this and why does it matter??

OK, so first of all, let's look at how the US dollar has been trading...

What's the first thing you notice in the charts below?

If you said "nothing", you're basically on the money! The US dollar index (DXY) and my own equal weighted EMFX (emerging market currencies) index have been locked into a very tight trading range, with more than 1 false breakout showing up across those 4 key USD charts.

Implied volatility typically tracks closely with realized volatility - of which there is very little.

Historically this type of trading often precedes either a turning point, a large/violent move, or both.

The market psychology and macro realities that create this type of market is basically exactly what we see right now: significant division between bulls and bears, and competing/conflicting macro data and central banking outlook.

In other words, it represents a deadlock between bulls and bears.

At some point the deadlock gets resolved and bulls join bears or vice versa and hence you get a big turning point or sharp move. All that is needed is a catalyst and/or some clarity on the macro front.

In the near term there are multiple candidates in terms of data and central bank meetings, so strap yourself in... things could be about to get very interesting for the dollar (and hence basically every other market/asset in the world given the tendency for earthquakes in the dollar to send shockwaves across global markets).

Last one I will leave you with is USD vs Gold implied volatility (this was in the latest Weekly Macro Themes report, where I talked about the US dollar, silver, and gold miners).

Could be barking up the wrong bush here, but it looks like gold is proffering a shot across the bows in terms of what could be in stall for the US dollar. For what it's worth, I have been bearish USD since the start of the year, and remain that way (until proven otherwise!).

Any comments, questions, just get in touch direct or by social media.

The main chart in this article came from the recently launched "Top 5 Charts Of The Week" report - which is our entry-level subscription service. Subscribe now and I'll send through the latest

Thanks,

Callum Thomas

Head of Research at Topdown Charts Limited

www.topdowncharts.com

Hozzászólások