Tuesday Technicals - 27 September 2016

- Callum Thomas

- Sep 27, 2016

- 3 min read

Here's the regular quick draw 5 macro technical charts (going as far as individual commodities, currencies, bonds, and sectors, as well as the rest of the major indexes and benchmarks). No comments on anything except the technical/price developments. Even if you're not technical analysis minded it's a useful way to keep on top of trends in some of the main financial markets and as a prompt for further investigation...

1. Crude Oil - At a critical point

-Downtrend line on the daily chart shows the dominant short term direction in crude oil. After touching this downtrend line the likely next move is down short term.

-RSI also sitting in a symmetrical triangle; coiling up for the next move (by the way, despite this bearish message, watch for any upside break of that downtrend line on price and go with it).

-On sentiment, the Sentix Crude Oil Neutrality Index shows extreme uncertainty... in recent history this sort of pattern has been short term bearish and indicative of a top.

Overall technical view: Bearish short term, but open minded on a break of that red line

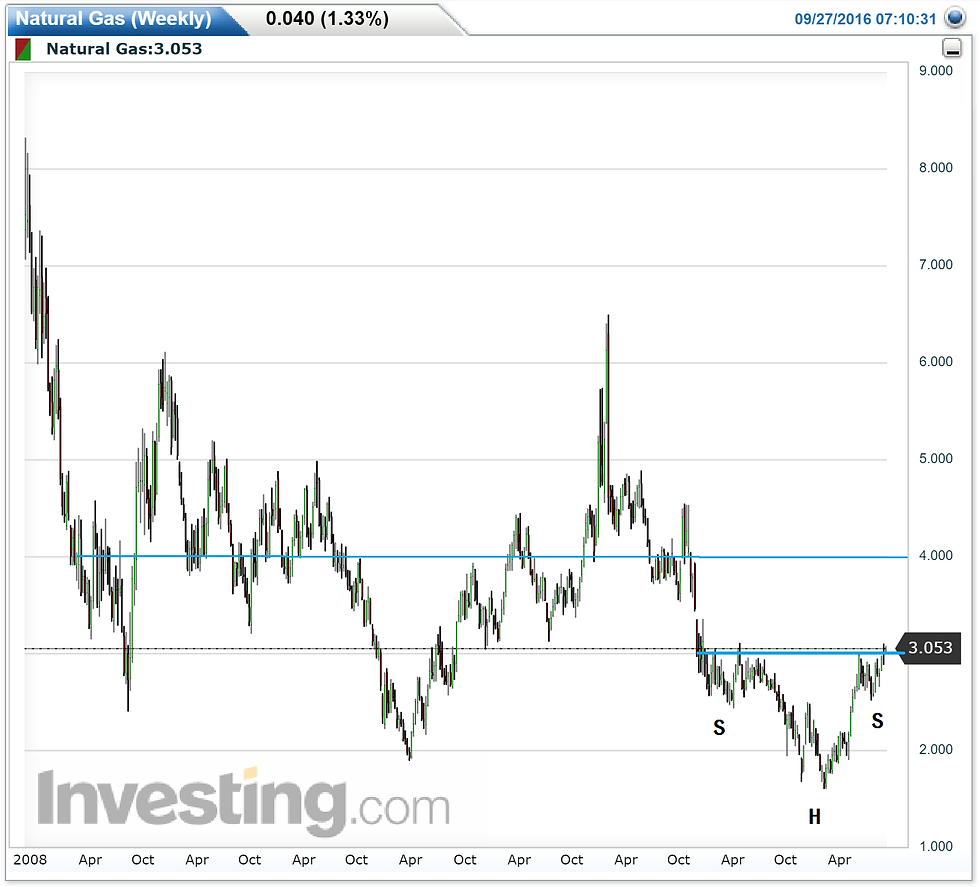

2. Natural Gas - Breakout

-Head and shoulders bottom playing through on the weekly chart, price has just broken through the neckline.

-The $3 mark remains important with the failed 2009 breach to the downside, and 2012 bottom confirmed around the $3 point; in this case it is the neckline for the H&S pattern.

-Medium term price target is $4 (simple head and shoulders measure rule, and that's where resistance is).

Overall technical view: Bullish medium term

3. Gold - Bull flag

-Bull flag continuing to play out on the weekly chart.

-Typically a continuation pattern, the measure rule says price target for an upside breakout would be above $1400

-Still dependent on an upside breakout; it will not be a "bull flag" unless and until it breaks to the upside, but if it does it will move above $1400 in short order and from that point the gold bull market will become the main narrative.

Overall technical view: Bullish bias, but wait for the breakout

4. US Small Caps - Closing in on resistance

-The Russell 2000 small cap index put in a major inverse head and shoulders pattern through 2015/16, which would suggest a mechanical price target north of 1400.

-It has managed to stay above the 50 day moving average despite a few dips in what has otherwise been a solid stretch of absolute and relative performance.

-On the relative performance (against the S&P500) aspect it seems to be in the process of breaking up through the line in the sand of the past few years which will support its run against resistance of 1275; a break of which will lift conviction.

Overall technical view: Bullish, gain further conviction on a break of 1275

5. Financials - Head and Shoulders Top

-Financials ETF just put in a head and shoulders top with the intraday break of the neckline; price target of H&S is a move back towards the lows of $18

-Second strike is that the gap down today also marks a downside break of the 50 day moving average.

-Third strike is the poor relative performance, with the ratio vs the S&P500 dropping below the point where major weakness erupted in June.

Overall technical view: Bearish short term

Thanks to StockCharts.com and Investing.com for charts.

Previous editions:

After wrapping up Tuesday Technicals – 27 September 2016, which focused on sharpening practical understanding and analytical thinking, it is interesting to see how those technical foundations connect seamlessly with real-world legal remedies. This transition feels natural because, much like technical problem-solving, litigation strategy also depends on knowing when and how to use the right procedural tools. This connects directly to extraordinary remedies such as SLP / Special Leave Petition and the transfer petition, both of which play a decisive role in the Indian judicial system.

Another factor to consider is that litigation does not always end at the first or second forum. Often, despite exhausting ordinary remedies, parties continue to face injustice or procedural unfairness. This is where the special leave petition becomes…

Interestingly, just as we often analyze technical trends and daily routines in [Tuesday Technicals - 27 September 2016], similar attention is needed when it comes to understanding our daily habits around food—especially sugar. Many people don’t realize that sweet cravings and sugar cravings aren’t just a matter of weak willpower—they are rooted in complex physiological and emotional responses. This connects to the larger issue of public health, where dietary habits formed early in life can influence long-term outcomes such as childhood obesity.

When we talk about reasons for craving sugar, it’s important to recognize that the body often sends signals for quick energy. Skipping meals, consuming highly processed foods, or even experiencing stress and lack of sleep can trigger these cravings. The…

Tuesday Technicals – 27 September 2016 focused on breaking down everyday food choices with a practical, no-nonsense approach — looking beyond taste and tradition to understand what actually goes into our bodies. Interestingly, that same philosophy connects seamlessly to how we now reimagine classic Indian snacks through a healthier lens. One such example that perfectly bridges technical nutrition thinking with everyday eating is the modern reinterpretation of dahi bhalla.

Traditionally, dahi bhalla has always been associated with indulgence — soft lentil dumplings, generous yogurt, sweet and tangy chutneys, and a fair amount of oil from deep-frying. But as nutrition awareness grows, another factor to consider is how preparation methods drastically influence dahi vada nutrition. What was once viewed as an…

<a href="https://www.google.com/">key</a>